who pays sales tax when selling a car privately in illinois

Use the illinois tax rate finder to find your tax. Who pays sales tax when selling a car.

How To Transfer A Vehicle Title In Illinois Dmv Connect

Illinois collects a 725 state sales tax rate on the purchase of all vehicles.

. Therefore your car sales tax will be based on the 25000 amount. If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership. Safety Administrations NHTSA odometer disclosure.

Although the buyer pays for this inspection the seller and buyer must agree on when and where the inspection is to be held. This tax is paid directly to the Illinois Department. WHEN SELLING YOUR CAR Reporting a wrong purchase price is FRAUD.

Illinois Sales Tax on Car Purchases. Illinois collects a 725 state sales tax rate on the purchase of all vehicles. The state where you pay vehicle registration fees is the one that charges the sales tax not the state where you made the vehicle.

As of January 1st 2022. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue. The Illinois state sales tax rate is currently 625.

The buyer will have to pay. There is also between a 025 and 075 when it. Arkansas House Bill would decrease car sales tax on.

It starts at 390 for. It ends with 25 for vehicles at least 11 years old. There is also between a 025 and 075 when it comes to.

Form RUT-50 Private Party Vehicle Use Tax Transaction Return due no later than 30 days after the purchase date of the vehicle. However you do not pay that tax to the car dealer or individual selling the car. This is the total of state and county sales tax rates.

If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. Can you transfer a title online in Illinois. There is also between a 025 and 075 when it comes to county tax.

If you are selling a car in illinois you must follow the following steps. The Illinois online system. How is sales tax calculated on a used car in Illinois.

This tax is paid directly to illinois department of revenue. Who pays sales tax when selling a car privately in illinois. For vehicles worth less than 15000 the tax is based on the age of the vehicle.

The buyer pays sales tax in Illinois which is 725. The Cook County sales tax rate is 175. Illinois collects a 725 state sales tax rate on the purchase of all vehicles.

Who pays sales tax when selling a car privately in Illinois. Form ST-556 Sales Tax Transaction. Illinois collects a 725 state sales tax rate on the purchase of all vehicles.

Sales taxes in Illinois are. Saying a SALE is a GIFT is FRAUD. Illinois Sales Tax on Car Purchases.

When you sell your car you must declare the actual selling purchase price. Who pays sales tax when selling a car privately in Illinois. You will subtract the trade-in value by the purchase price and get 25000.

Steps To Take When Selling A Car In Illinois - Cash Cars Buyer. In addition to state and county tax the City of.

Illinois Trade In Tax Coming Chicago Il Marino Cdjr

What Is The Sales Tax On A Car In Illinois Pasquesi Sheppard Llc

How To Pay Illinois Sales Tax Online 9 Steps With Pictures

Illinois Bill Of Sale Forms And Registration Requirements

How Much Does It Cost To Transfer A Car Title In Illinois

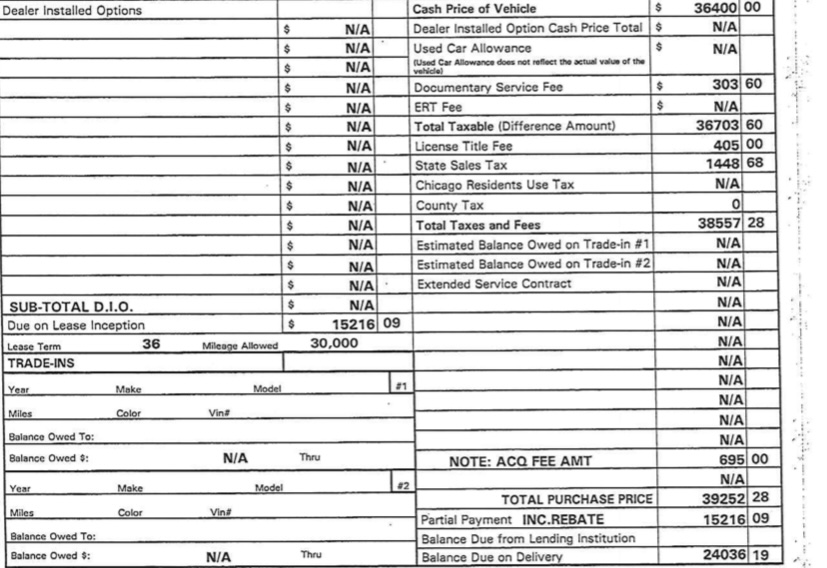

The Correct Tax Amount For Illinois Ask The Hackrs Forum Leasehackr

License Title Tax Info For New Cars Chicago Il Marino Cjdr

Illinois Sales Tax Credit Cap Important Information

Illinois Imposing Car Trade In Tax On Jan 1 Dealers Call It Double Taxation

Car Tax By State Usa Manual Car Sales Tax Calculator

Free Illinois Bill Of Sale Forms Pdf

Important Tax Changes For Illinois Car Buyers The Driven Fiduciary

Free Bill Of Sale Forms 24 Word Pdf Eforms

How To Pay Illinois Sales Tax Online 9 Steps With Pictures

How To Sell A Car In Illinois Metromile

How To Close A Private Car Sale Edmunds

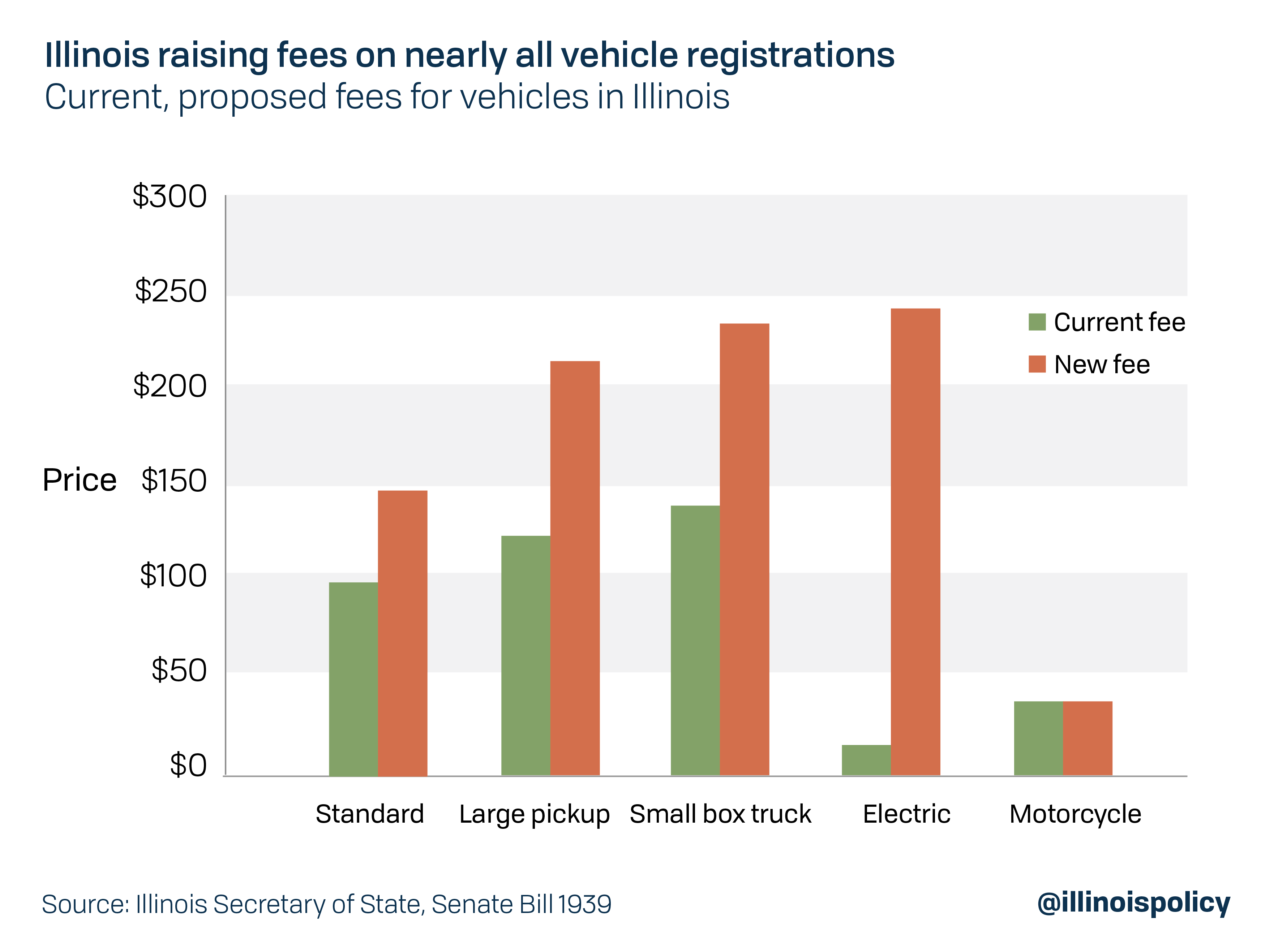

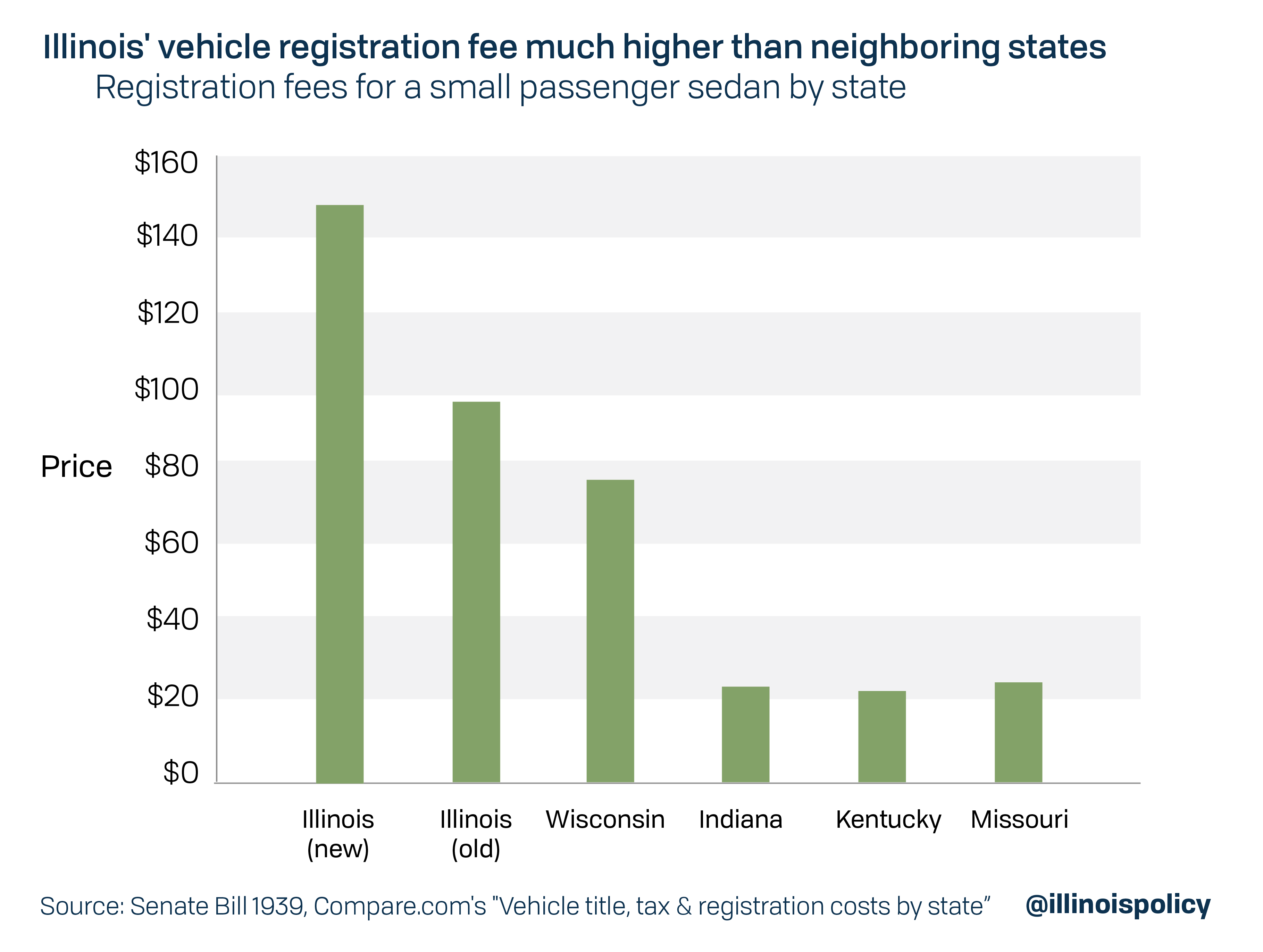

Illinois License Plate Sticker Among Most Expensive In The Nation